Change Your Monetary Future with Expert Tips on Credit Repair

Change Your Monetary Future with Expert Tips on Credit Repair

Blog Article

How Credit Rating Repair Works to Get Rid Of Errors and Increase Your Credit Reliability

Credit scores fixing is a vital process for people seeking to improve their creditworthiness by resolving errors that may compromise their monetary standing. By thoroughly examining credit rating reports for common mistakes-- such as incorrect individual details or misreported repayment histories-- people can launch a structured disagreement procedure with credit score bureaus.

Understanding Debt News

Credit report records offer as an economic picture of an individual's credit background, outlining their borrowing and payment behavior. These reports are put together by credit score bureaus and consist of essential info such as credit score accounts, arrearages, payment background, and public documents like liens or bankruptcies. Monetary organizations use this information to evaluate a person's creditworthiness when obtaining loans, credit score cards, or home mortgages.

A credit record generally includes individual information, consisting of the individual's name, address, and Social Safety and security number, along with a list of debt accounts, their standing, and any kind of late settlements. The report likewise outlines credit scores queries-- circumstances where lending institutions have accessed the record for analysis objectives. Each of these parts plays a vital role in figuring out a credit rating, which is a mathematical depiction of creditworthiness.

Recognizing credit score records is vital for customers intending to handle their economic health effectively. By consistently assessing their reports, individuals can make certain that their credit rating background accurately shows their financial behavior, hence positioning themselves favorably in future loaning undertakings. Understanding of the contents of one's credit scores report is the very first step toward successful credit history fixing and overall economic wellness.

Usual Debt Record Errors

Errors within credit rating reports can significantly impact a person's credit report and overall monetary health. Common credit score report errors consist of inaccurate personal info, such as incorrect addresses or misspelled names. These inconsistencies can lead to complication and might influence the evaluation of credit reliability.

An additional constant mistake includes accounts that do not come from the individual, typically arising from identity theft or imprecise data entrance by financial institutions. Combined documents, where someone's credit score info is integrated with one more's, can additionally take place, specifically with individuals who share comparable names.

Additionally, late settlements might be inaccurately reported as a result of processing mistakes or misunderstandings concerning settlement dates. Accounts that have actually been worked out or settled may still look like superior, more making complex an individual's credit rating account.

Additionally, inaccuracies relating to credit rating restrictions and account equilibriums can misstate a consumer's credit score usage proportion, an important aspect in credit report. Identifying these errors is important, as they can result in greater rate of interest, funding denials, and raised problem in acquiring credit report. Consistently examining one's credit record is a positive measure to determine and fix these usual errors, therefore protecting monetary health and wellness.

The Credit Rating Repair Process

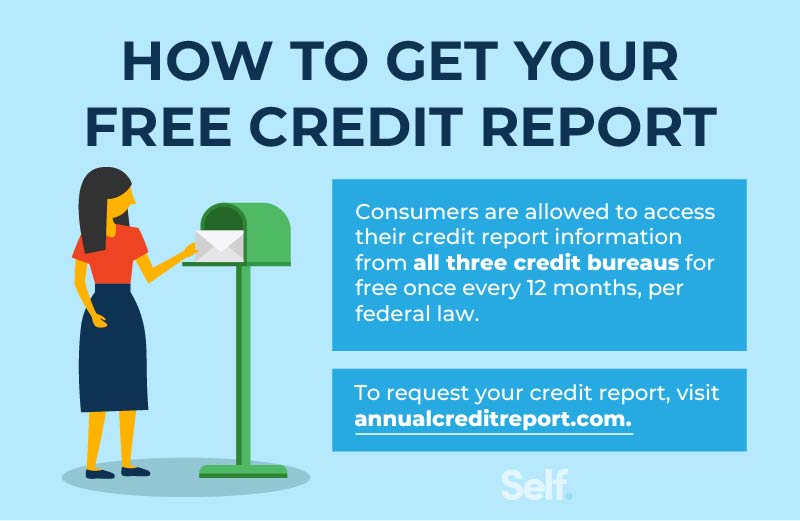

Browsing the credit score repair service process can be an overwhelming job for lots of individuals looking for to improve their financial standing. The trip begins with acquiring a thorough credit score report from all three significant credit bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows customers to identify and comprehend the aspects affecting read what he said their credit report

When the credit rating record is assessed, people need to classify the info right helpful resources into precise, inaccurate, and unverifiable products. Precise details ought to be kept, while errors can be objected to. It is important to collect supporting documents to confirm any type of insurance claims of mistake.

Next, people can select to either manage the procedure individually or employ the help of specialist credit score repair services. Credit Repair. Professionals often have the know-how and sources to navigate the intricacies of credit history reporting legislations and can streamline the procedure

Throughout the credit scores repair process, keeping prompt settlements on existing accounts is essential. This shows liable monetary behavior and can favorably affect credit report. Inevitably, the credit history repair work process is an organized approach to determining concerns, disputing errors, and fostering much healthier monetary behaviors, bring about enhanced creditworthiness over time.

Disputing Inaccuracies Efficiently

An efficient conflict procedure is essential for those aiming to rectify inaccuracies on their credit score records. The initial step entails obtaining a duplicate of your credit record from the major credit history bureaus-- Equifax, Experian, and TransUnion. Review the report thoroughly for any inconsistencies, such as inaccurate account information, dated details, or deceptive entries.

Next, start the conflict procedure by calling the credit bureau that provided the report. When submitting your conflict, give a clear explanation of the error, along with the sustaining evidence.

Advantages of Debt Repair Service

A multitude of advantages comes with the process of credit repair, substantially affecting both economic security and general lifestyle. One of the main advantages is the possibility for better credit rating. As mistakes and errors are corrected, people can experience a significant rise in their credit reliability, which straight affects funding approval rates and interest terms.

In addition, credit report fixing can improve accessibility to desirable financing alternatives. Individuals with greater credit score scores are more probable to certify for reduced rate of interest on home loans, auto car loans, and personal finances, eventually causing significant cost savings in time. This better monetary versatility can promote major life decisions, such as acquiring a home or investing click site in education.

With a more clear understanding of their credit report circumstance, individuals can make enlightened choices relating to credit report usage and administration. Credit report fixing usually entails education on economic proficiency, empowering individuals to take on better investing routines and preserve their credit report wellness long-lasting.

Verdict

In conclusion, credit score repair work acts as an important system for enhancing credit reliability by dealing with inaccuracies within credit report records. The methodical recognition and disagreement of errors can cause substantial improvements in credit report, thereby helping with accessibility to far better financing options. By comprehending the nuances of credit score reports and employing reliable conflict approaches, individuals can achieve higher monetary health and security. Ultimately, the credit rating repair procedure plays an important role in cultivating notified economic decision-making and long-term financial wellness.

By thoroughly examining credit records for common mistakes-- such as incorrect personal details or misreported repayment backgrounds-- people can start an organized conflict process with debt bureaus.Credit rating records offer as a monetary picture of a person's credit background, detailing their loaning and repayment behavior. Awareness of the components of one's credit scores report is the first action toward successful credit rating repair work and general economic well-being.

Errors within credit report reports can dramatically influence a person's credit scores rating and overall economic health and wellness.Moreover, inaccuracies regarding credit limits and account balances can misrepresent a consumer's debt usage proportion, a crucial factor in credit scores racking up.

Report this page